What you need to know about markup vs margin

Markup vs margin: they’re not the same. You may think I’m stating the obvious here, however, there often seems to be some confusion about what they both are.

Businesses can make the mistake of using markup to calculate their selling price, and making the assumption that their markup is also their gross profit margin. This is not correct.

For recruitment businesses it’s important to have a clear understanding of what they both are. A lot of effort goes into placing a candidate, so it’s vital to make sure you are calculating your profit correctly. Knowing how to apply markup and margin to your recruitment business can also increase your bottom line.

To help you out, we’ve pulled together this comparison guide and shared the winning formulas on how to calculate both.

Markup and margin made easy with our calculator!

Check out our markup and margin calculator

Markup Vs Margin: What are They?

Before we can go into the nitty-gritty of how to calculate your markup and your margin, we need to clarify exactly what they both are and how they are different.

What is Margin?

Your margin is the difference between your selling price and the money you have to spend to create your product. The margin is worked out as a percentage of your selling price.

With regards to recruitment, the money you have to spend might include any of the following:

- Costs to advertise the role

- Your employee’s salaries

- Phone bills

- Travel costs to visit the client

- Subsistence expenses for client meetings

What is Markup?

Your markup is when you create a product for one cost and then sell it for a higher price. Marking up your products means you are able to earn profit on your products. Your markup is the difference in cost between your selling price and the amount you spent to make your product.

Markup is commonly expressed as a percentage, which is useful as you can be certain that your recruitment business is creating a proportional amount of money for each of your products, regardless of whether your costs go up or down. As your business grows, your markups will scale in proportion.

Markup Vs Margin: How are They Different?

Margin and markup are two different perspectives on the relationship between price and cost (much like a cup being half full or half empty).

As previously mentioned, margin is the difference between your selling cost and the amount you spent to make the product, and markup is the difference between your selling price and your profit.

There are benefits to both:

- Markup ensures that you are generating revenue every time you make a sale.

- Margin helps you to track how much profit you make for each sale.

- Markup is good when you’re getting started as it helps you fully understand the money coming in and out of your business.

- Margin clearly highlights the impact your sales have on your bottom line, as it is a reliable and accurate way of calculating the difference between your price and your cost.

Click here to read more about the maths behind markup and margin.

How to Calculate Your Markup and Your Margin

Before you can calculate your margins and markups, you need to get to grips with these terms:

Price/Revenue:

Your earnings before deducting costs

Cost/COGS:

Costs to create sales items

Gross Profit:

Your revenue, minus your COGS

Calculating Your Markup

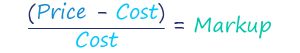

You can calculate your markup using this formula:

1. Find your gross profit

To work this out you have to minus your cost from your price

2. Divide your gross profit by your cost

You’ll then have your markup. To turn it into a percentage, simply multiply it by 100 and that’s your markup %.

Here’s a simple example of how the formula works:

So, when you multiply 1 by 100, you get a percentage of 100%.

Calculating Your Margin

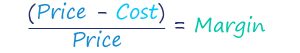

To calculate your margin, use this formula:

1. Find your gross profit

Again, to do this you minus your cost from your price.

2. Divide your gross profit by your price

You’ll then have your margin. Again, to turn it into a percentage, simply multiply it by 100 and that’s your margin %.

Here’s an example of how your margin formula looks in action:

And when you multiply 0.5 by 100, you get a margin percentage of 50%.

Calculating Markup and Margin for a Placement

As a recruitment consultant, you’ll typically follow business guidelines for what margin you can work at.

The example below shows the process to calculate markup and margin.

You’re placing a candidate at £325 per day and are working at 20%. To work out the clients charge rate to meet your 20% margin target divide £325 by 80 and then times (x) by 100.

325/80*100 = £406.25.

- Client charge rate = £406.25

- Candidate pay rate = £325

Markup and margin can then be calculated easily:

- £406.25 – £325 = £81.25 (this is the gross profit you’ll make per day for the duration of the placement)

- £81.25/£325= 25% markup

- £81.25/£406.25 = 20% margin

In other words:

- Markup = gross profit divided by pay rate (£81.25/£325 * 100 = 25%)

- Margin = gross profit divided by charge rate (£81.25/£406.25 *100 = 20%)

So, for this placement your markup is 25% and your margin is at the 20% you needed it to be.

Getting to grips with markup vs margin in relation to your business is vital. Do the maths wrong and you may end up out of pocket without realising it. Get it right, and you’ll improve your profit and grow your recruitment business.